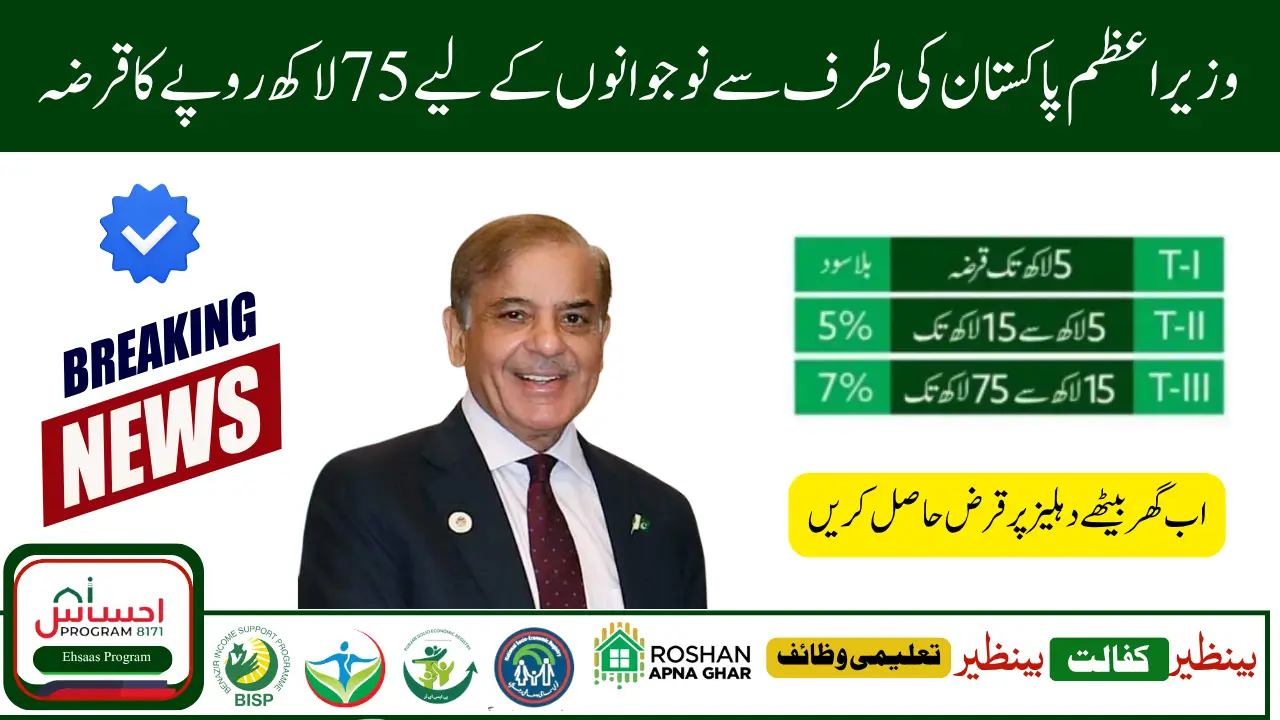

Why the PM Youth Loan Scheme 2025

In Pakistan today, many young people have ideas, ambitions, and dreams. But the biggest barrier is often capitalizing the money to start something.The PM Youth Loan Scheme 2025 is a government program aimed at empowering youth by providing low-interest or subsidized loans to start businesses, buy equipment, or expand ventures.

Calling it a step by step guide to apply for PM Youth Loan Scheme 2025 is apt, because many applicants get stuck at procedural steps. In this guide, I explain in conversational Pakistani style how you as a student, fresh graduate, or young entrepreneur can successfully apply for this loan.

You Can Also Read : How to Check 8171 Web Portal Payment

Understanding the PM Youth Loan Scheme 2025

Before jumping into how to apply, you must know what this scheme is, why it was launched, and what kinds of projects it covers. This helps you tell if your idea qualifies.

The PM Youth Loan Scheme 2025 is an initiative by the Government of Pakistan (usually under the Prime Minister’s office or a youth development / finance ministry) to support young entrepreneurs. The idea is to provide credit facilities (loans) at subsidized interest rates, minimal collateral or guarantee, and favorable repayment terms. The scheme is intended to:

- Encourage youth entrepreneurship

- Reduce unemployment

- Promote small and medium enterprises (SMEs) by youth

- Harness the creativity and potential of our young generation

What kinds of projects are acceptable?

Usually, the scheme allows:

- Small businesses: shops, cafes, local services

- Manufacturing or cottage industry units

- Agricultural enterprises (small scale)

- Technology / IT / digital services

- Purchase of machinery, equipment, tools

- Upgrades or expansion of existing youth-run ventures

However, some projects might not be allowed for example, speculative ventures, illegal trade, or sectors barred by government policy. Always check the latest scheme guidelines in your province or region.

So when you apply, you must pitch a feasible business idea, show that you can manage it, and present the required documents.

Eligibility Criteria: Are You Qualified?

Before going into application steps, confirm that you satisfy all eligibility conditions. If you don’t, your application will be rejected.

Typically, the eligibility criteria include:

- Age Limit

Applicants must be youth for example, in many schemes, the age range is 18 to 45 years. Check the exact age range for the 2025 version. - Citizenship / Residence

You must be a Pakistani citizen and have a valid national identity card (CNIC). Some schemes require you to reside in a particular province or district. - Education / Skill Requirement

Minimum education may be matric, intermediate, or diploma/degree in some cases. Or, at least, basic literacy and ability to run a business. - Business Plan / Viable Project

You must have a concrete idea, plan, or existing micro enterprise. - No Serious Loan Defaults

Applicants often must not have major defaults in previous government loans or banking history. - Collateral or Guarantee (if required)

Some parts may require guarantee or collateral, depending on the loan amount. - Age and Income Conditions

Sometimes certain categories like students may get special treatment; or income ceilings if required.

Check the official announcement or the institution administering the scheme in your province (federal, provincial youth development board, small enterprise authority) to confirm the precise criteria.

If you satisfy all these, then you can move ahead with the application process.

Documents You Need to Prepare

You must gather all required documents, because missing anything can cause delay or rejection. Below is a bullet list of typical documents:

- CNIC (National Identity Card) copy

- Domicile certificate or proof of residence

- Recent passport-size photographs

- Business plan / project proposal (written)

- Quotation(s) for machinery, goods, tools (if buying equipment)

- Bank account details / proof of bank account

- Educational certificates (matric, intermediate, whatever is required)

- Proof of existing business (if applicable), e.g. registration, sales record

- Guarantee or collateral documents (if scheme demands)

- Any registration or trade license (if required)

- Affidavit or undertaking (if required)

Step-by-Step Application Process for PM Youth Loan Scheme 2025

Now, here is the heart: how you go from idea to approved loan. Below is a step by step guide that works for most provinces, though some details may differ slightly region to region.

Step 1: Study the Official Announcement / Guidelines

First, find the official notification for PM Youth Loan Scheme 2025 from government websites e.g. the Prime Minister’s office, youth development board, provincial government site, or small business support authority. Read all the terms, conditions, eligibility, and features. This helps you understand your rights and obligations.

Step 2: Prepare Your Business Idea / Project Proposal

You should prepare a clear business plan or project proposal. It should include:

- Description of business (what you will do)

- Market analysis (who are your customers)

- Cost estimates (equipment, materials, rent)

- Revenue / income projections

- Timeline (when you will start, break-even)

- Repayment plan (how you will pay back loan)

The stronger your proposal, the higher chance of approval.

Step 3: Fill the Application Form

Usually, there will be an online application portal or paper form. If online:

- Go to the official portal

- Register with your CNIC, mobile phone

- Fill personal details, business plan, financial information

- Upload scanned copies of your documents

If offline (paper):

- Obtain the loan application form from the relevant office

- Fill in carefully in legible handwriting

- Attach photocopies of all required documents

- Submit the form to designated office

Step 4: Submit Form & Documents to the Designated Office

After filling:

- If online, click Submit and get a printout or registration number

- If offline, deliver to the relevant office (provincial youth affairs, small business office, designated bank branch)

- Ask for a receipt or acknowledgement this proof helps in follow up

Step 5: Scrutiny & Verification by the Scheme Authority

Once submitted, the responsible authority will:

- Check your application, documents

- Verify your CNIC, domicile, education, business plan

- Possibly conduct a site visit (if you already have a location)

- Validate quotations, projections

If anything is wrong or missing, they may ask for corrections or additional documents.

Step 6: Approval & Sanctioning of Loan

If everything is in order, your application goes before a committee or authority which approves or rejects. If approved:

- You will get a sanction letter

- Terms and conditions (interest rate, repayment schedule, disbursement) will be given

- You may need to sign an agreement

Step 7: Disbursement of Funds & Utilization

After signing:

- The loan amount is released, often to your bank account or via the bank

- You use the funds for your project (as proposed)

- Keep invoices, receipts, records

- Start your business operations

Step 8: Repayment & Monitoring

Once business is running:

- Repay according to schedule (monthly, quarterly, etc.)

- Maintain accounts, submit progress reports or audits if required

- Avoid default that damages credit and future chances

Sometimes the scheme authority or bank may monitor your project to ensure proper use.

Key Steps at a Glance

Below is a summary:

- Check official guidelines and eligibility

- Prepare business plan / project proposal

- Gather required documents

- Fill application (online or paper)

- Submit to designated office or portal

- Verification and scrutiny by authority

- Approval and sanctioning of loan

- Disbursement of funds

- Utilize funds as proposed

- Repay on schedule and maintain records

Timeline & Processing Duration

How long does the entire process take? While it varies, typical timeline is:

| Step | Estimated Time |

| Document preparation & business plan | a few days to 1 week |

| Application filling & submission | 1–2 days |

| Verification and scrutiny | 1 to 3 weeks |

| Committee decision / approval | 1 week |

| Disbursement | a few days after approval |

So, overall, expect 2 to 6 weeks from start to fund disbursement, depending on your province’s efficiency.

You Can Also Read ; How to Resubmit Admission Slip for BISP Taleemi Wazaif

Tips to Increase Chances of Approval

Because many apply, you must make your application stronger. Here are helpful tips:

- Be realistic in your numbers, don’t overestimate profits

- Make your proposal clean, neat, free of errors

- Use genuine quotations from trustworthy vendors

- Attach proof of market demand (surveys, references)

- Follow all guidelines, missing small items may lead to rejection

- Submit early, avoid last-minute rush

- Keep spare copies of everything

- Maintain good credit / avoid defaults

- Stay responsive in case scheme office asks questions

What to Do If Your Application Is Rejected?

Rejection is disappointing, but it doesn’t mean the end. You can:

- Request feedback ask why rejected

- Correct deficiencies (e.g. missing documents, weak proposal)

- Reapply (if allowed)

- Approach microfinance banks or alternative youth loan programs

- Seek help from a mentor or youth business incubator

Tracking & Following Up Your Application

You should always track your progress. Steps to follow:

- Use the application reference number to check status online

- Call or visit the office with your receipt

- Keep a log of all communications

- If delayed beyond the normal period, escalate to higher authority or media

- Document your follow ups

Common Challenges and Solutions

Some common difficulties:

- Missing documents — solution: use the checklist, double-check before submission

- Delays in verification — solution: follow up persistently

- Project idea not convincing — solution: refine business plan, show research

- Collateral requirement — solution: look for guarantors or smaller loan category

- Default risk — solution: make repayment realistic, don’t overborrow

Being prepared for challenges gives you an edge.

You Can Also Read : BISP New Registration for Ineligible Women

Real-Life Example (Hypothetical)

Let me share a simplified example to help you see how the process works on ground:

Suppose Ali, aged 25, from Lahore, wants to open a small computer repair shop plus accessories. He meets eligibility (CNIC, age, basic education). He makes a business plan:

- Rent shop space, electricity, tools, spare parts stock

- Projects revenue from service and accessory sales

- Prepares quotations from suppliers

He applies online via provincial youth portal, uploads all docs, gets acknowledgement. They verify his CNIC, check his shop premises. The committee approves PKR 500,000 at subsidized rate. Funds are deposited to Ali’s bank account. Ali buys equipment, opens a shop, and then starts earning. He pays back in monthly installments.

This example follows all the steps we listed.

Final Conclusion & Tip

The PM Youth Loan Scheme 2025 offers a golden chance for young Pakistanis to turn dreams into real businesses. If you carefully follow the eligibility, prepare your documents well, craft a realistic business plan, and follow up persistently, your application is likely to succeed. My key tip is: start early, double-check every paper, and always keep proof of every step you take.

FAQs

Can a student apply for PM Youth Loan Scheme 2025?

Yes, often students (with suitable age and eligibility) can apply. But some schemes may require you to show ability to run a business or partner with someone. Always check the official guidelines.

What is the interest rate of the PM Youth Loan Scheme 2025?

The interest rate is typically subsidized and lower than market rates. It may vary by province or category. Check the scheme’s official notification for exact rate (e.g. 4%, 6% etc.).

Is collateral always required?

Not always. For smaller loans, sometimes collateral or guarantee is waived or a third-party guarantee may suffice. But for larger amounts, security might be needed.

Can I apply in multiple districts or for multiple projects?

Usually you apply for one project in one location. Applying for multiple projects may lead to rejection or complications. Always review scheme rules.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.